You’ve cleaned. You’ve packed. You’ve said goodbye to the flat — and to that weird cupboard nobody ever opens. And then you are hit by the question: Can a Landlord Deduct Cleaning Costs from a Deposit?!

Then the landlord confirms:

“Yes, we will deduct cleaning from your deposit.”

No explanation.

No invoice.

Just confidence.

So let’s settle this once and for all.

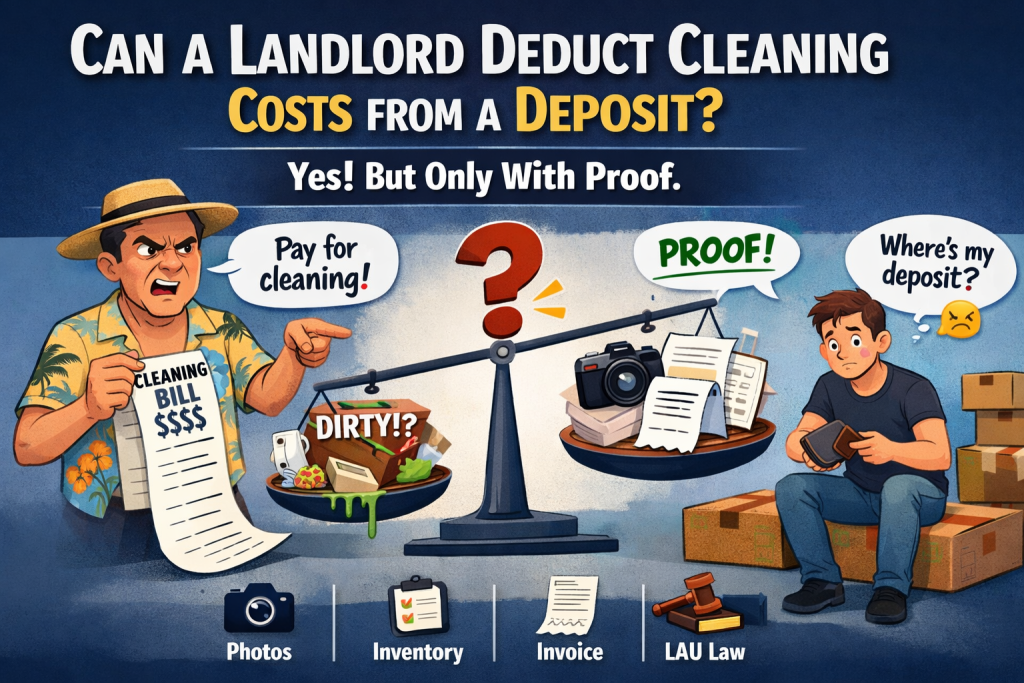

Can a Landlord Deduct Cleaning Costs from a Deposit: The Short Legal Answer (For Impatient Humans)

Yes — a landlord can deduct cleaning from a deposit in Spain.

But only if very specific conditions are met.

Otherwise?

It’s illegal.

Even if it’s sunny.

Even if it’s Costa Blanca.

Even if “everyone does it”.

The Rule That Controls Everything (LAU, Not Opinions)

In fact, spanish rental law (Ley de Arrendamientos Urbanos) is refreshingly clear:

👉 A deposit is not a cleaning fund.

👉 It is only for real damage or negligence.

In other words:

- Living = allowed

- Dirt caused by life = allowed

- Dirt caused by chaos = deductible

Can a Landlord Deduct Cleaning Costs from a Deposit: Normal Wear vs. “This Needs a Hazmat Suit”

This is where most fights in Torrevieja, Alicante, Orihuela Costa, Benidorm begin.

✅ Normal Wear and Tear (No Deduction)

- Dust on surfaces

- Limescale in bathrooms (hello, Costa Blanca water)

- Light grease in the kitchen

- Floors that show… existence

Thus, this is legal living, not a crime scene.

❌ Excessive Dirt (Possible Deduction)

- Trash left behind

- Strong odors

- Mold caused by negligence

- Thick grease layers

- Pet hair everywhere (when pets weren’t allowed)

This is when professional cleaning becomes justified.

Can a Landlord Deduct Cleaning Costs from a Deposit: Real Cases from Real Rentals

🏠 Case 1: “Professional Cleaning Required” (Alicante)

Tenant leaves flat clean but not hotel-perfect.

Landlord deducts €200.

📉 Illegal.

Why? No entry inventory, no proof, no invoice.

🏖️ Case 2: The Sand Problem (Torrevieja)

Sand in sofas, dirty kitchen, food smells.

📈 Legal deduction.

Why? Photos + invoice + condition beyond normal use.

🧾 Case 3: The Invisible Receipt (Orihuela Costa)

Cleaning deducted. No receipt provided.

📉 Illegal.

Indeed, no invoice = no deduction. Spain is strict about this.

Costa Blanca Myth: “It’s a Holiday Area, So Cleaning Is Automatic”

Nope.

Nice try.

Even in short-term or furnished rentals:

- Cleaning is not automatically deductible

- Convenience is not a legal argument

- “Next tenant arrives tomorrow” is not your problem

The law works the same in Madrid, Alicante, Torrevieja, and Mars.

Can a Landlord Deduct Cleaning Costs from a Deposit: What Landlords MUST Show to Deduct Cleaning

If money is leaving your deposit, the landlord must provide:

✔️ Entry condition proof

✔️ Exit condition proof

✔️ Cleaning invoice

✔️ Clear justification

No evidence = no deduction.

Spain doesn’t do “trust me, bro”.

What About Contract Clauses?

Ah yes, the classic line:

“Tenant must pay professional cleaning upon exit.”

Sounds serious.

Often isn’t.

In fact, courts regularly rule these clauses invalid unless:

- The flat was delivered professionally cleaned

- This was documented

- The tenant returned it in worse condition

Otherwise, it’s just legal decoration.

Deposit Return Deadline (Yes, There Is One)

Landlords typically have 30 days to return your deposit.

Unjustified delay?

👉 Interest may apply.

Sunshine does not pause the law.

Can a Landlord Deduct Cleaning Costs from a Deposit: How Tenants Win These Situations (Without Lawyers)

So, before handing over keys:

- Take photos and video

- Clean reasonably (not obsessively)

- Save messages

- Ask for confirmation

Think of it as cheap insurance — with better ROI than arguing.

Can a Landlord Deduct Cleaning Costs from a Deposit: The Irony Nobody Talks About

When cleaning is actually needed, professional cleaning with an invoice:

- Protects landlords

- Protects tenants

- Prevents disputes

- Speeds up deposit returns

Turns out paperwork beats drama.

FAQ — Cleaning & Rental Deposits in Spain

❓ Can a landlord deduct cleaning costs in Spain?

Yes, only if the property is returned significantly dirtier than at move-in and this can be proven.

❓ Is professional cleaning mandatory?

No. Only cleanliness comparable to move-in condition is required.

❓ Can cleaning be deducted without an invoice?

No. Ever.

❓ Does this apply in Costa Blanca?

Yes — Torrevieja, Alicante, Benidorm, Orihuela Costa, all the same law.

❓ What if the landlord refuses to return the deposit?

You can formally claim it and often recover the full amount plus interest.

Can a Landlord Deduct Cleaning Costs from a Deposit: Final Verdict (Clear Enough for Everyone)

✔️ Cleaning deductions are conditional

❌ Automatic fees are illegal

📸 Proof beats opinions

🧾 Invoices beat confidence

Or, put simply:

If the flat doesn’t look worse than when you moved in, your deposit should come back intact.

Sun or no sun.